With an ever-expanding economy, Georgia’s State Board of Workers’ Compensation supports over a quarter million employers and nearly 4 million employees. EMPLOYERS® specializes in small business insurance in Georgia, and nationwide. We can help you understand if you need workers’ compensation insurance for your business and tell you more about how Georgia’s laws work. We cover Georgia’s class codes for agents, required forms and postings for business owners, and provide information on how much it costs businesses in Goergia to provide workers’ comp compared to the rest of the nation below.

What are Georgia’s Workers’ Compensation Insurance Requirements?

In Georgia, any business that regularly employs three or more people is required to have workers’ compensation insurance by the State Board of Workers’ Compensation. This includes:

- Full-time employees

- Part-time employees who work regularly on a part-time basis (e.g. those who work only weekends)

- Corporate Officers

Though corporate officers are considered employees, they may choose to waive workers’ compensation coverage for themselves. Workers’ compensation is not required in Georgia for:

- Sole proprietors

- Partners

- Contractors

Sole proprietors and partners are not considered employees in Georgia, meaning they do not have to be included for workers’ compensation. But if you are a sole proprietor or partner in Georgia and you would like to be covered under your company’s workers’ compensation insurance policy, you do have that option. You must notify your insurance carrier in writing – ask your insurance agent for help with the proper forms.

While contractors are not included as workers’ compensation covered employees in Georgia, they may be independently liable for any subcontractors they hire to help do work for your business.

Penalties and Fines

Businesses that fail to carry workers’ compensation insurance, as required under the Georgia Workers’ Compensation Act, face a civil penalty between $500 and $5,000 per occurrence. Plus, employers who refuse to carry workers’ comp coverage, or willfully neglect to get coverage, can be charged with a misdemeanor, facing fines of $1,000 to $10,000 and/or jail time for up to 12 months if convicted.

Workers’ Compensation Rates in Georgia

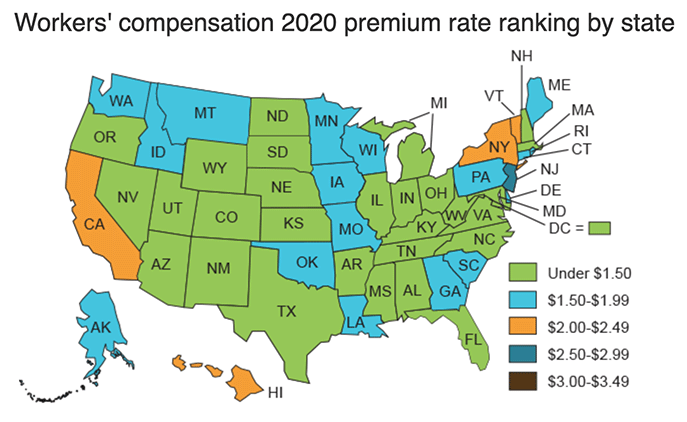

Because each state has different requirements for workers’ compensation insurance, the amount a business owner pays for workers’ comp in Georgia will likely vary. Factors that could impact your rates can include business risk, the level of benefits you choose, medical regulations and more. Here’s a look at where Georgia lands for workers’ compensation insurance rates compared to the rest of the nation:

Source: Oregon Department of Consumer and Business Services, 2020

According to a study by the State of Oregon’s Department of Consumer and Business Services, workers’ compensation insurance is projected to cost approximately $1.50 to $1.99 for every $100 of payroll in Georgia. The best way to understand your costs, benefits, and other policy details is to connect with a local agent to get a quote.

Georgia Workers’ Comp Forms Library

There are some workers’ compensation forms and notices you must print and post at your place of business. There are also forms you may be required to include in staff handbooks or new employee orientations. Download our Required Postings and Forms packet, or visit our Georgia Claim Forms page to download individual notices in English and Spanish.

Visit Georgia’s Claim Forms Library

A complete resource roundup for handling injured employees in Georgia is the EMPLOYERS Georgia Managed Care Program Guide, which explains the required forms, how to file claims, and the wellness, care, and recovery process for Georgia businesses and injured employees in detail.

Georgia Workers’ Comp Class Code Finder for Agents

Workers’ Comp codes are sometimes different from state to state. However, there are also universally accepted class code lookups from the National Council on Compensation Insurance (NCCI) and North American Industry Classification System (NAICS). Georgia is one of more than 30 states that accept the NCCI workers’ compensation class codes.

More Georgia Workers’ Comp Resources

Georgia’s Injured Employee Hotline℠

Call Now: 855-365-6010 – open 24 hours a day, 7 days a week. Staffed by registered nurses specifically trained to provide medical guidance over the phone for work-related occupational disease or injury.

Georgia HR, Safety & Risk Support

For anyone who handles human resources, safety and risk responsibility for their business, we have you covered. EMPLOYERS Loss Control Connection℠ goes beyond the standard for workers’ comp providers to give you tools and resources for more than just basic safety and compliance. We care about your employees’ wellbeing, how you hire and retain employees, crafting top quality training programs, and other essentials that help your business be more successful. Examples of how we help include:

- Making tedious tasks, from developing postings, coming up with job descriptions and salary benchmarking, even drafting employee safety guidelines or complete handbooks and programs, simple.

-

Delivering content that can be customized for your business and is updated to assist you in compliance with Georgia’s statutes and federal law. Employee documents are available in both English and Spanish.

- Providing a forum to have your questions on workplace safety situations, risk management, and human resources quickly answered by other users who have been in your shoes.

- A resource library and automated news feed feature to help you and your employees meet and maintain training requirements more easily.

As part of our commitment to your business’ success, we make all these resources and more available to you as part of your EMPLOYERS policy. To find out more:

Learn the Full Benefits of

Workmans’ Comp Coverage You Need

Interested in learning more about how EMPLOYERS can help your Georgia business? Get started now with workers’ compensation insurance from EMPLOYERS!

Thousands of small businesses trust EMPLOYERS for providing cost-effective workers’ compensation insurance for over a century. With our competitive pricing, financial stability and dependability, claims service, safety training and risk advisory programs, EMPLOYERS remains focused on keeping America’s small businesses not only working, but working safely.